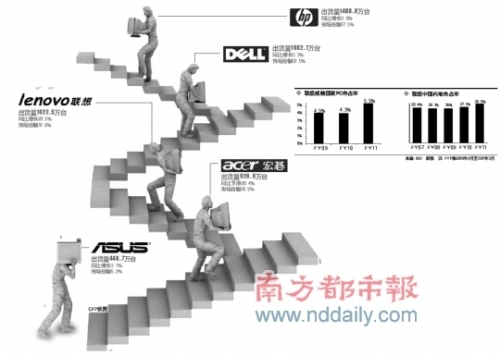

On the one hand, PC industry leader Hewlett-Packard also has to split the PC business because it is too low profit; while on the other hand, Lenovo from China is ambitious to claim the throne of first place. It can be said that each spends its eyes.

On the one hand, PC industry leader Hewlett-Packard also has to split the PC business because it is too low profit; while on the other hand, Lenovo from China is ambitious to claim the throne of first place. It can be said that each spends its eyes. A few days ago Gartner lowered its global PC market growth forecast from 9.3% to 3.8%. According to data from market consulting agencies, the notebook industry may face negative growth in 2011. This expectation fully demonstrates the current difficulties facing the PC industry. However, when the industrial downturn is often a change in the industrial structure, PC companies of Chinese descent are using a mode of low-cost, continuous pressure on HP and Dell.

In the face of strong pressure from Chinese brands, Hewlett-Packard and Dell are already tired of the PC business. The industry expects that the Chinese descent "top" PC industry is not far behind.

The focus of the PC industry moved eastward more than a month ago. Hewlett-Packard, the global leader in the PC industry, announced the spin-off and independent operation of the PC business. The potential buyers of the HP PC business after spin-off are nothing more than Asian companies such as Samsung, Acer, or Lenovo. In addition, HP's spin-off also caused anxiety among many Taiwanese foundries. If HP's PC business is sold to Samsung Electronics, which has strong parts and production capabilities, it is simply a disaster for some Taiwanese foundry manufacturers.

The changes in the two major PC makers reflect a major shift in the global IT industry chain over the past 20 years.

First talk about the hardware industry. With the formation of the Wintel architecture of Microsoft+Intel, the global IT industry chain has changed from the original vertical integration to the horizontal division of labor, forming the industrial chain structure of “brand dealers-manufacturers-parts manufacturers-hardware platform vendorsâ€. A horizontal layer of companies all perform their duties and expand in their own areas. Finally, HP, Dell, Lenovo, and Acer were established at the level of PC brands. Manufacturers include Taiwan manufacturers such as Foxconn, Quanta, Compal, Wistron, etc., and the hardware platform is Intel's only. Big.

Since the 1990s, due to cost pressures, the global hardware industry chain has begun to migrate to Asia (mainly China). The first to enter mainland China is Taiwanese manufacturers who are engaged in OEM. They first formed an agglomeration effect in the Pearl River Delta, then went north to the Yangtze River Delta, forming two major cities in the global IT manufacturing industry, and also achieved Foxconn, Quanta, etc. OEM giants. Since then, Titan, TSMC, SMIC and other giants have also built production bases in the mainland. Even Intel, which has always been more cautious about overseas deployments, has set up chip test and packaging bases in Chengdu and Dalian.

Today, the new wave of migration has begun again, and the cause is still the cost. With the rising cost of coastal areas, Foxconn has begun to accelerate the transfer of production bases from the Pearl River Delta and the Yangtze River Delta to inland cities such as Henan, Chongqing, and Chengdu. In the future, Shenzhen will retain only R&D and high-end manufacturing functions.

PC business is still the mother of Golden Chicken Although the PC industry due to the global economic downturn and the impact of the iPad, this year may see negative growth, although industry leader Hewlett-Packard suspects PC business profits are too low to split the PC business. However, the global PC shipments of nearly 400 million units each year make the PC industry one of the few “100 billion dollar club†industries. In the eyes of many PC giants, the PC business is still a hen that will only lay eggs.

Dell CEO Michael Dell recently said in an interview that in fact, after the PC era did not come, the PC's market capacity is still quite large, Dell will be more proactive to improve their PC business model, "no matter How Dell will continue to play an important role in the PC market rather than give it up." Dell also said that in the current situation, Dell hopes to continue to expand its market share through the division of the PC business.

Liu Chuanzhi, who vowed to be the No. 1 in the world, was optimistic about the PC business. In an exclusive interview with this newspaper, Liu Chuanzhi pointed out that, including Taiwanese and notebooks, demand is still growing and it can also bring a lot of cash flow to enterprises. “As with diesel oil and salt, PC is a necessities of life. Even if there are various types of distortions in the products, the demand space will always exist. In the competition, some companies have lower and lower gross margins, and the costs are getting higher and higher. Said that the increase in gross margins, the cost of the decline." Financial report shows that Lenovo Group's first fiscal quarter (April 1 to June 30) achieved sales of 5.92 billion US dollars, net profit of 108 million US dollars, gross margin reached 12.5% Even if compared with the 15% profit rate of Apple Mac computer, there is not much difference. Chen Xudong, general manager of Lenovo China, also said, “Some people think that PC will not succeed. In fact, there is still a lot of room for global growth.â€

Even for HP, the PC business remained profitable during the worst times. In fact, HP's PC business is still profitable. As of July 31, the profit for the fiscal quarter was US$567 million, and the profit rate still exceeded 5%.

In addition, although the mobile Internet is becoming the frontier of global IT industry competition, PC is still the most important application terminal, and it is the most important information tool for business users. For PC manufacturers, the PC business is often a stepping stone for business users' informatization business. Through PC, it can drive the sales of other high-end IT industries and applications. It is precisely because of this that HP has been widely questioned by the industry after it announced that it would split the PC business. Many critics have pointed out that HP’s move is too short-sighted and will therefore lose a large customer base.

It is reported that HP is also considering whether to split the PC business. Hewlett-Packard's chairman Rainer said last week that PC business is likely to remain in HP, and HP's spin-off PC business plan may change.

Rennes said: "If we can not provide better choices to customers and investors, PC business will continue to stay in HP."

The advantage of China's manufacturing industry chain is due to the low profit margin of PC business. In the eyes of US companies seeking high profit margins and taking Apple and IBM as examples, this is a promising industry. This is why Hewlett-Packard and Dell are fully transforming their services. HP plans to split the PC business. Despite its stated intention to continue to strengthen its PC business, Dell aims to increase sales of value-added products and services through PC services.

However, for Chinese companies accustomed to working in low-profit industries, gross profit of over 10% still has a huge appeal. Although the brand influence is not as good as Hewlett-Packard and Dell, but using price advantage, Acer and Lenovo have gained a lot of market share from Hewlett-Packard and Dell in the past few years, and because of the low-price strategy, Hewlett-Packard and Dell are forced to follow up. The latter grew tired of PC business. Once HP actually splits the PC business, it will undoubtedly be a big plus for Acer, Lenovo, Asus, and other "Chinese pedigree" companies.

As Acer’s Global Vice President and President of China Ai Rensi previously commented, the exit of some competing brands will provide Acer with more market space. According to the latest data, due to aggressive orders from channel distributors, Acer’s orders in September have seen an explosive growth. In the first week of September, it reached 1.2 million to 1.4 million units, approaching the level of a single month in July, among which European ordering was the most active.

In Liu’s opinion, the scale and low-cost operation is still the essence of the traditional PC business. The current China, because it has mastered the advantages of the manufacturing end of the industry chain, is undoubtedly the ideal choice for large-scale low-cost operation. In April-June this year, global PC sales increased only 2.7% year-on-year, but Lenovo not only increased its sales by 23.1% year-on-year, but also surpassed Acer by 12.2% in market share ranking third in the world, and the gap with Dell has narrowed to 0.6. percentage point. In the context of the global PC industry's declining profits, Lenovo’s gross margin with cost advantages is rising (Maori reached 12.5% ​​in the first quarter of this year), and the competitiveness of large-scale, low-cost models continues to increase.

“In addition to the CPU, almost all computer component production is concentrated in China, and all ODM manufacturers are also concentrated in China. Lenovo and Acer are more likely to integrate upstream manufacturing industry chains and control costs. As long as HP and Dell are still doing It will inevitably face price competition from Chinese PCs. Under such a competitive pattern, the European and American departments will probably end up withdrawing from the market." Acer area leader has privately told reporters.

Related reports PC upstream and downstream battles, Ultrabook or due to price for the market to save the weak market In order to save the weak PC market, Intel's Ultrabook (ultimate) army is about to debut, looking forward to the characteristics of light and low power consumption, a new notebook Generations. The CEO of Intel, Otellini, promoted the new concept of Ultrabook and defined the Ultrabook as a notebook savior. In the IDF venue, the Ultrabook exhibition area was also set up. It is worth noting that Dell HP is both absent. Intel also mentioned in the speech that at the end of the Spring Festival consumer season in the end of the year, Lenovo, Acer, Asus, Toshiba, etc. will have Ultrabook shelves for sale, not to mention Dell HP.

Upstream and downstream PCs are hoping to borrow a copy of the Ultrabook, but the core of market share with the tablet is the price. From the current Ultrabook (AC ER) released by the Ultrabook this point, 30% more expensive than traditional laptops, the lowest price of 7999, Acer has always been known as the killer price of mainstream brands, other manufacturers is difficult to publish more competitive prices. Therefore, including Acer and the upstream ODM industry and business are complaining to Intel, hoping to reduce the ultra-pole CPU price. Compal bluntly, if the processor price remains the status quo, Ultrabook plans will inevitably be stranded due to the incompetence of PC manufacturers.

"Ultrabook" or 40% increase in notebook growth On September 16, 2011, Acer released its own UltrabookA spire S3 hummingbird notebook in Beijing. This is the first ultrabook published by mainstream manufacturers, so Intel attaches great importance to it. Syria's self-help forum.

Alan Ren, global vice president and president of China, said that compared to its competitors, Acer Ultrabook has fast networking capabilities and industry-leading hardware solutions; using Window s operating system to meet the needs of mainstream users. Regarding the price issue that the industry is very concerned about, Ai Rensi believes that Acer ultra price will drop next year, and it may launch models of less than 6,000 yuan.

For the pricing of Ultrabook and its share after listing, Yang Xu stated that Ultrabook has a long way to go. It needs to go through an ever-evolving process. With the continuous improvement of technology, the ultrabook will be different. Large, the price will also be reduced with the scale of production, by the end of next year is expected to reach 40% market share.

Ai Rensi said that Ultrabook will eventually win in the competition between laptop and tablet. For the Windows 8 operating system debuted recently, Ai Rensi and Yang Sy were both optimistic. Ai Rensi believes that Window s8 will make the touch screen a new feature for notebooks, and the combination of Ultrabook and Win8 will enable users to have better options.

Credit Suisse also forecast that thin and light notebooks such as Ultrabook will lead to a 40% increase in shipments in 2012. However, Morgan Stanley is not optimistic. It believes that the slowdown in demand for business PCs and the decrease in shipments in the notebook market will limit the use of ultrabooks. Although emerging markets will also drive some shipments, PC shipments in 2011 will increase. From the annual growth rate of 2% to zero growth, the year-on-year growth of PC shipments in 2012 also fell from 4% to 3%.

PC makers call for CPU price cuts Recently Acer (Taiwan) President Lin Xianlang and Compal President Chen Ruicong sent signals to Intel in an interview that they hope to reduce the price of Ultrabook Ultrabook processor to better control the sale price. Below 1000 US dollars. It is understood that notebook manufacturers had hoped that Intel will offer 50% discount on Ultrabook processor, but Intel's final discount of 20%. Acer pointed out that Intel also hopes that Ultrabook's price can be less than 1,000 US dollars, but refused to provide subsidies on processor prices, brand manufacturers may therefore have to use low-end models of processors, or shrink in other accessories. At the same time, the enthusiasm and efforts of manufacturers to promote Ultrabook is bound to be blocked.

At the same time, Compal said that Intel's current processor price is unlikely to help the Ultrabook to occupy 40% of the notebook market share. He added that if Ultrabook's sales are not good, and Apple continues to enjoy high profit margins, the Wintel Alliance will have to take some measures, otherwise the Ultrabook program will inevitably be stranded due to the inability of the PC field.

IDC analysts said that the only opportunity for the forthcoming Ultrabook series to outperform the rival Apple MacBook Air is to reach the correct price as quickly as possible. IDC’s vice president said: “I think Ultrabook is a great product line and is in line with the needs of the PC market. If the Ultrabook can reach the right price will probably become the mainstream. However, I think the first launch models will make them become price factors. Less public market."

Analysts believe that a reasonable price band must be around $799. At present, Intel gives these notebook manufacturers considerable pressure (for example, the thickness must not exceed 0.8 inches). Intel must balance the hardware specifications and prices with notebook makers. For example, if the conditions are slightly relaxed, the price of notebooks can be reduced by 200 US dollars. If the price of the Ultrabook can only be maintained at around $1,000, the possible effect is that sales cannot be increased significantly. The notebook market of over $1,000 is actually very small, and even if you can get a considerable share in this market, it is still a relatively small market. The other fact is that the biggest player in this market is Apple, which is the main cause of this market price sensitivity is so high.

RO/Pipeline water dispenser

By connecting directly to your existing water supply, point-of-use (POU) bottleless water dispensers provide an endless supply of quality drinking water for your office or workplace. They are a cost-effective option that eliminates the hassle of storing and lifting heavy 5 gallon water bottles and are perfect for offices who want to reduce environmental impact. Bottleless water coolers only require an annual maintenance check and filter replacement, so they are easier to maintain with minimal service calls.

Bottleless water coolers offer a win-win proposition for your employees and your business.

Ro/Pipeline Water Dispenser,Pipeline Water Dispenser,Hot And Cold Pipeline Water Dispenser,Desktop Pipeline Water Dispenser

Ningbo Feter Electrical Appliance Co., Ltd. , http://www.feter-china.com